Week Ending January 23, 2026

BEEF

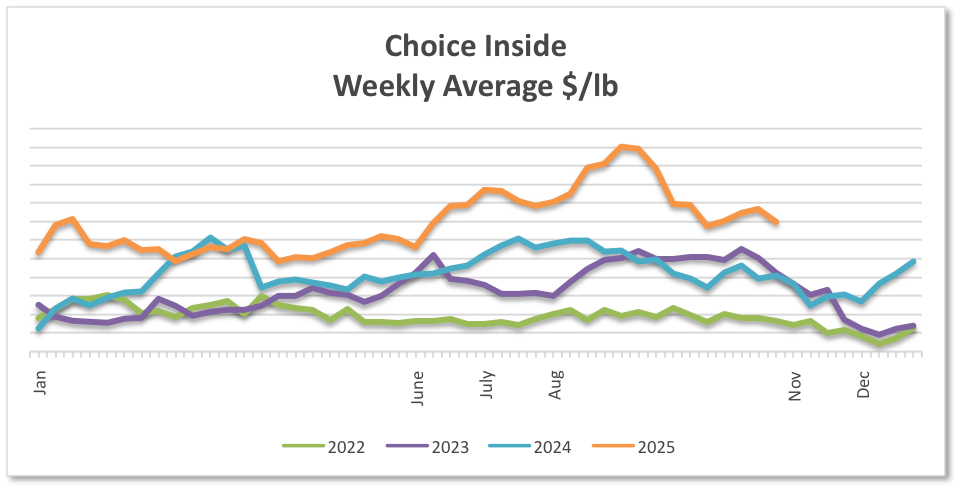

The market is steady to firmer. Total beef production for last week was down 27.0% versus the prior week and up 1.7% compared to the same week last year. Year to date, total production is down 4.0% compared to the same period last year. The total headcount for last week was 429,000 compared to 433,000 for the same week last year. Year to date, the total headcount is 28.92 million head, which is down 6.8% from last year. Live weights for last week were even at 0 lbs. versus the prior week and are up 27 lbs. from the same week last year. The category continues to have unsettled overtones due to price offerings that are higher YOY. The overall cutout is showing signs of firming up and remains about 10% to 15% higher year YOY. Live futures are showing strength with an uptick in values for February and April. Cattle slaughter statistics have been reported over the last month which is helping buyers and sellers alike. The spread between choice and select grades remains fairly tight. Market values are showing some strength due to short production weeks and limited inventory for spot trading.

Grinds – The market is steady. Demand is moderate to good and tends to pick up in January following the holidays. Overall pricing is up about 49% YOY on 81% grinds. On the supply side, Mexican imports have been halted due to issues with the New World Screwworm. Trade levels on 73% and 81% are holding even.

Loins – The market is steady to firmer. Demand is showing some strength for early January. Higher retail prices continue to suppress consumer purchases. Inventories vary by supplier and packing plant. Market levels on choice product are showing signs of improvement.

Rounds – The market is steady to firmer. Weekly demand is improving as consumers get back to more routine beef purchases. Demand from grinding operations dropped significantly but has the potential of picking up. Availability varies by packer and sourcing plant. The market has strong undertones.

Chucks – The market is steady to firmer. Demand is picking up with some retail feature business expected in January. With sellers moving out lingering inventory in December, supply and demand are in better balance. Supply varies by packer and sourcing facility. Trade levels on chucks and clods have been pressured higher.

Ribs – The market is weaker. Demand has fallen off now that holiday shipments have been completed. Sellers are trying to move lingering inventory and keep supply in balance with demand. Supply varies by packer, plant, and grade. Values have been pressured lower.

PORK

The market is steady. Total pork production for last week was down 26.3% versus the prior week and down 3.7% compared to the same week last year. The total headcount for last week was 1,978,000, compared to 2,064,000 for the same week last year. Live weights for last week were up 1 lb. compared to the prior week and up 2 lbs. versus the same week last year. Lean hog futures are showing some weakness as the February and April contracts inch lower. Demand for fresh pork is showing signs of firming up with New Year’s Day promotions. Cutout values and primal levels have been soft in recent months but have stabilized over the last couple of weeks. Retail demand is meeting industry expectations as grocers use pork as a key feature component. In the fresh meat complex, volume on loins, butts, hams, and ribs is starting to show week-to-week stability. Tariffs have industry participants concerned but limited information is being reported about any actual effects. At the current time, approximately 25% of U.S. production goes to the export channel. Market values in most categories have steady overtones as the industry moves to close out the year.

Bellies – The market is steady to weaker. Demand from the retail and foodservice channels is starting to stall following the holidays. After raw bellies peaked in July, the market has had a soft bias since mid-September. Supply is available. The market has been declining slightly.

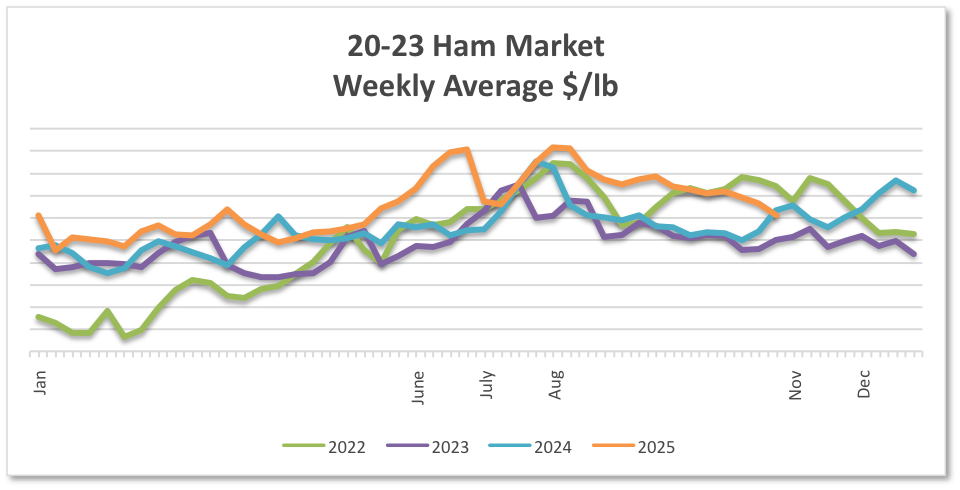

Hams – The market is steady. Demand for bone-in product is stable as further processors turn their attention to the Easter Holiday. Boneless hams are well supported in the retail deli and foodservice channels. Export business to Mexico on bone-in hams is fair. Supply is tight. Market levels are mostly flat.

Loins – The market is steady. Retail demand for bone-in and boneless loins is moderate to good with retail features for the New Year. Export demand for boneless strap-on loins is fair at best. Supply varies by packer. The market has been moving sideways.

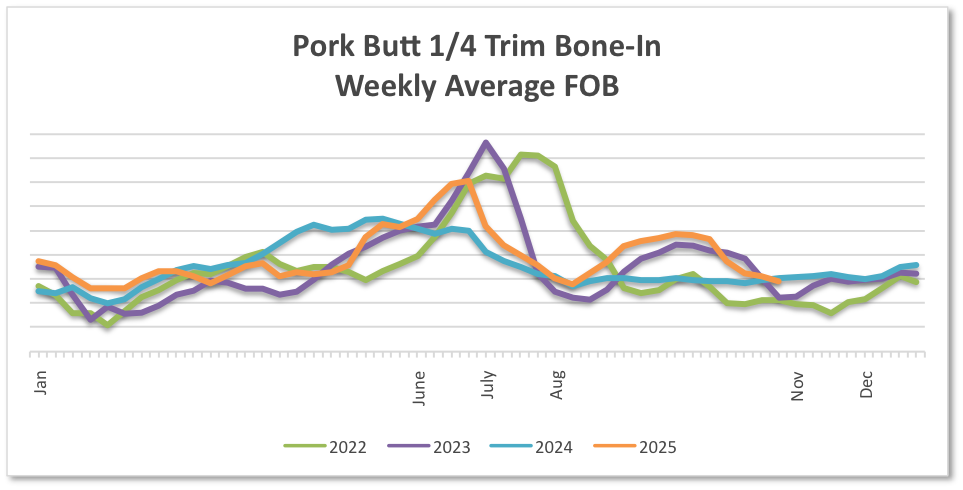

Butts – The market is steady. Retail business is moderate and is starting to show signs of strength as we get closer to year end shipments. Export demand to Mexico and the Pacific Rim is status quo. Supply is available. Trade levels have firmed up recently.

Ribs – The market is steady. Retail and foodservice demand is moderate during the non-seasonal time of year. Buyers are looking for spot deals for freezer inventory. Supply varies by packer and plant. The market on spareribs, St. Louis Ribs, and back ribs is mostly flat.

CHICKEN

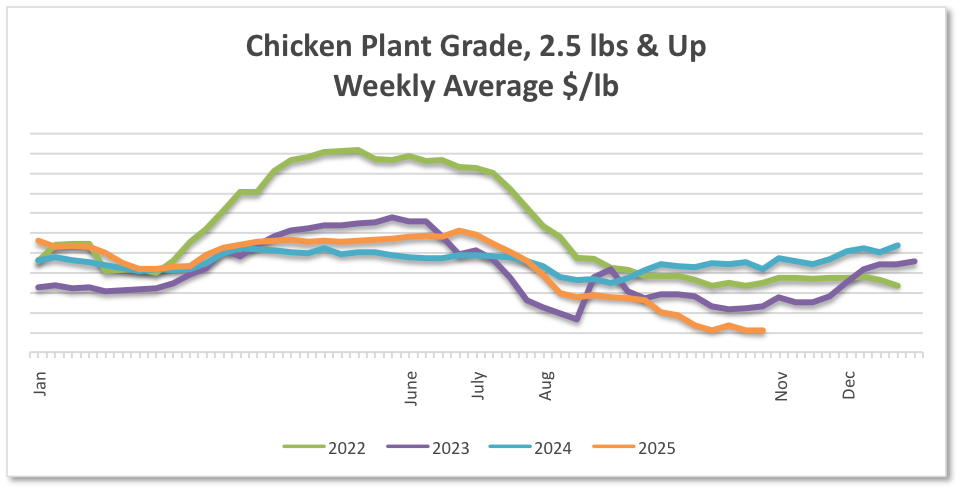

The market is steady. The total headcount for the week ending 12/20/2025 was 174,945,000 as compared to 170,104,000 for the same week last year. The average weight for last week was 6.59 lbs. as compared to 6.55 lbs. for the same week last year. Demand from the retail and foodservice channels continues to be adequate and robust enough to keep inventories clearing on a weekly basis. Supply is in balance with demand as processors better manage weekly slaughter rates. WOGS and breast meat are reported to be a full-steady. Demand for the remaining categories of tenderloins, wings, and dark meat are moderate to good. Export business on leg quarters and whole legs is status quo and meeting industry expectations. Improved slaughter numbers YOY continue to add more finished pounds to the marketplace. Market levels are mostly flat as supply and demand patterns appear to be on equal footing.

WOGS – The market is steady to firmer. Volume from retail deli and fast-food QSR’s is strong with consumers looking for quick meal solutions during the holiday rush period. Supply is tight on smaller WOGS. Market levels are being pushed higher on spot trading.

Tenders – The market is steady. Demand from the foodservice and QSR channels has been consistent throughout December. Custom portioning is in balance with supply. Supply is available but not in excess. The market on select and jumbo sizes is holding even.

Boneless Breast – The market is steady. Retail demand for case-ready product and foodservice demand for jumbo CVP breast meat is moderate to good. Suppliers are trying to push the market higher while buyers are trying to hold off purchases. Supply is available but not in excess. The market is flat.

Leg Quarters and Thighs – The market is steady. Retail demand for drums and thighs is stable. Export business on whole legs is status quo. Supply is available. The market on drums and thigh meat is mostly unchanged.

Wings – The market is steady. Demand from foodservice and further processors is in balance with supply. Supply is available on most sizes. The market is moving sideways.

TURKEY

The market is steady. The total headcount for the week ending 12/20/2025 was 3,404,000, as compared to 3,041,000 for the same week last year. The average weight for last week was 33.53 lbs. as compared to 34.58 lbs. for the same week last year. Retail and foodservice demand is static as the industry proceeds through the holiday season. With limited supply and flat demand patterns, very little information on spot trading is being reported. Whole birds, back-half parts, and boneless breasts continue to be sought after. The supply side was constrained in calendar 2025. With the respiratory virus reported earlier in the year, bird weights were down which had a negative impact on production pounds. Less production has also resulted in lower cold storage inventory. Asking prices are holding within established ranges due to tight supply on boneless breast, drums, and wings. Market levels across most categories are a full-steady.

Whole Birds – The market is steady. Very few spot transactions are being reported. Due to tight supply, some industry players are taking a look at booking whole birds earlier than expected in the new year. The market is holding even.

Breast Meat – The market is unsettled. Domestic demand from the retail, foodservice, and QSR channels is status quo. Fresh and frozen supply is tight with limited offerings. Market levels are flat.

Wings – The market is steady to firmer. Export business on whole wings is fair. Domestic volume on two-joint wings is strong in combination with tight supply. Supply for cut wings is tight. The market has shown some upward movement.

Drums and Thigh Meat – The market is steady. Export demand for drums is status quo for this time of year. Domestic demand for ground turkey continues to be robust. Supply is barely adequate on parts and thigh meat. The market is moving sideways on the back half of the bird.

SEAFOOD

White Shrimp – The market is firmer. Supplies are barely adequate to adequate while maintaining a firm undertone.

Black Tiger Shrimp – The market is firmer. Supplies are barely adequate to adequate while maintaining a firm undertone.

Gulf Shrimp – The market is firmer. Supplies are barely adequate to adequate while maintaining a firm undertone.

North American Lobster Tails – The market is steady to weaker. The warm-water tail market continues to face broad discounts as sellers respond to weak demand and increased competition. Pricing remains under pressure as participants work to encourage movement in an otherwise subdued marketplace.

Salmon – The market is firmer. Farmed salmon is firmer with pricing influenced by sellers’ supply positions. The West Coast whole fish market is barely steady. Supplies are barely adequate and unquoted in some instances. Europe is reporting a firmer market. Norwegian and Scottish whole fish supplies are adequate to barely adequate with moderate demand. The Chilean whole fish market is firmer. Supplies are adequate with moderate to active demand.

Cod – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Flounder – The market is steady and mostly unchanged.

Haddock – The market is firmer. There is a steady to firm undertone in the market. Demand is moderate, while supplies have tightened.

Pollock – The market is firmer. Supplies are adequate with moderate demand.

Tilapia – The market is unsettled. There are reports of slow demand, which has the potential to create long inventory positions.

Swai – The market is steady to firmer.

Scallops – The market is steady to firmer. Supply is barely adequate, particularly for large sizes. Demand remains lackluster. However, there is a firmer undertone in the market.

DAIRY

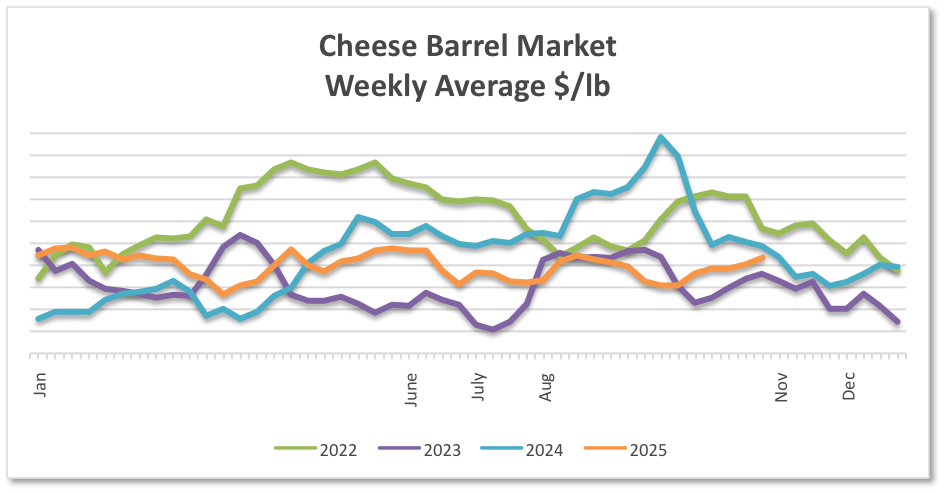

CHEESE

The market is mixed. The CME Block market was mixed as the week progressed. The CME Barrel market moved weaker as the week progressed. Both markets trended slightly weaker than the prior week. In the East, cheese production is steady to strong. As some facilities have planned downtime during the holidays, other facilities are taking in the extra available milk. Spot milk in the region is readily available. In the Central region, milk output is steady and remains up from a year ago. Plant managers in the region are not in the market for additional volume due to downtime for holidays. Cheese production in the region is steady to lighter. In the West, lighter milk production in certain parts of the region is contributing to lighter spot volume demand. Cheese production schedules are steady. Sellers in the region note better inventory positions at the end of 2025 compared to the end of 2024. Retail demand is steady. Bulk cheese producers indicate demand is abnormally light for this time of year. Cheese exports are offsetting the light bulk production with higher-than-normal demand from other countries.

In Europe, milk production varies from steady to stronger. European milk production is reported to be up for December. European cheese production schedules are steady, and prices are reported to be trending downward. Spot load availability is mixed. Demand for foreign type cheeses in the retail segment varies from steady to strong. Foodservice demand for foreign type cheeses is steady. Inventories are reported to be steady. Demand from international buyers varies from steady to strong. According to the USDA, price decreases for European produced cheese are garnering interest from international buyers.

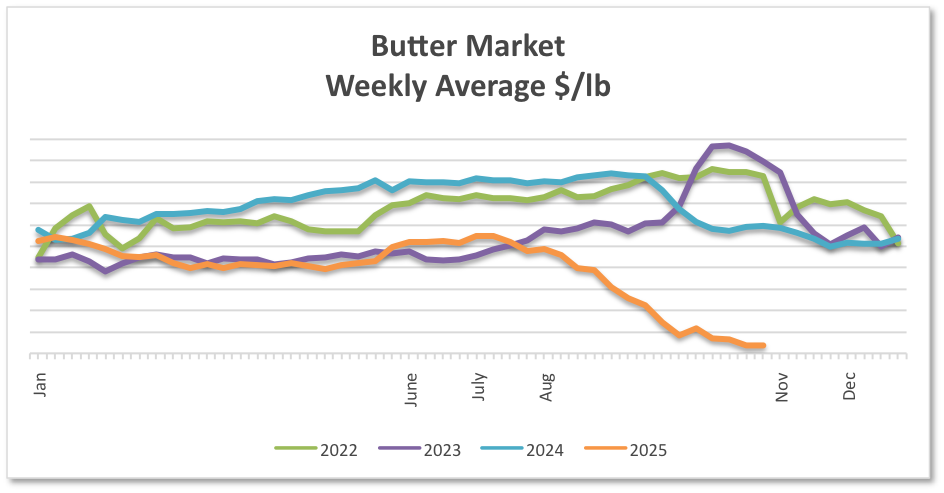

BUTTER

The market is firmer. The butter market moved firmer as the week progressed and trended firmer than the prior week. Milk outputs are steady and cream is widely available around the country. In the East, butter production is increasing. Many plants are taking in extra loads of milk and cream as plants have scheduled downtime for holiday breaks. Churns are operating at or near capacity seven days a week to build inventory for 2026. In the Central region, milk output is steady. Component levels are up from this time last year. Cream production in the region is seasonally strong. Volumes are reported to be more available as plant managers are purchasing fewer loads during the holiday season. Butter makers note ample cream is on hand. In the West, butter makers note milk intake volumes vary from steady to increasing. Cream loads are more available in the region. Spot cream demand is mixed. Butter production schedules in the region are busy as producers run their churns to build retail butter inventories.

Retail demand for butter is steady due to lower prices. Inventories of retail and food service size packs are low though increased production is expected to increase this. Domestic butter demand varies from steady to stronger. International demand for butter is strong. According to the USDA, there is strong demand from export purchases in recent weeks which has kept inventories of 82% butterfat butter tight. Loads of 80% butterfat butter remain available. Export demand of butter is steady. Export demand is robust enough that bulk butter loads for domestic buyers are slightly tight.

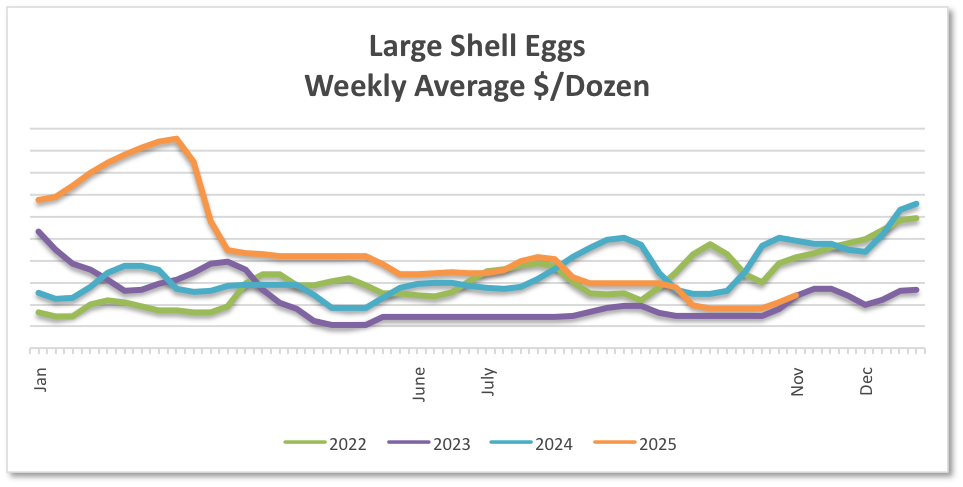

EGGS

The market is fair. Retail demand is generally described as fair heading into the final week of the year. While some suppliers expect modest improvement tied to colder weather, many report that holiday demand was limited. With wholesale prices at roughly 18-month lows, market participants increasingly view retail price reductions as necessary to support improved in-store movement. Foodservice and distribution channel movement remains subdued. Several sources cite soft QSR demand, as consumers prioritize holiday-related spending, limiting discretionary foodservice occasions.

Market levels have softened on medium sizes and large sizes. National weekly reports show shell egg inventory up 4.6% and breaking stock inventory up 13.0% over last week.

Demand in the egg products category is steady to weaker. Liquid whites and yolks are being sourced below quoted levels on the open market. Dried products are weaker with the bulk of year-end coverage already secured.

FLUID MILK

The market is strong. Milk output nationwide is strong, though some regions did not experience any volume growth. Milk volumes are up compared to this time last year. Milk components are seasonally high thus providing ample amounts of cream in the market. In the East, milk output from the farm increased as favorable weather improved cow comfort. Due to the upcoming holiday and school closures, milk and cream were widely available on the spot market. In the Central region, milk output is steady week-to-week and is up from this time last year. Cream production in the region is strong while demand is lighter due to planned holiday downtime. There is plenty of cream available in the Central region and they anticipate multiple to remain low through the end of the year. In California, week-over-week milk production is stronger. Some processors in the Central Valley note capacity is tight as planned holiday downtime occurs. Spot milk loads are available. Farm level milk outputs in Western states vary from steady to stronger. Handlers note heavy rains and flooding have negatively impacted cow comfort and lightened milk production in parts of the Pacific Northwest. The recent weather challenges have also caused transportation delays for haulers. Farm level outputs in the mountain states vary from steady to stronger. Cream volumes are readily available. Condensed skim milk loads are readily available. According to the USDA, stakeholders report lighter condensed skim milk demand in California, which is partly attributed to processing facilities permanently closing. Demand is stronger in the West outside of California.

Slow market activity during the end of year holidays is having a negative impact on demand for all Classes, according to the USDA. Class I demand is lighter. Bottling facilities continue to be slow as educational institutions are closed for winter break. Bottling is expected to increase after the New Year. Class II production is light. Class III production was steady to strong. Spot sales are increased as excess milk is available from other producers. Some cheesemakers did not bring in extra loads of milk due to planned downtime during the holiday. Class IV butter makers were active as producers took advantage of cream and milk availability to keep churns operating at or near capacity to alleviate a backlog of raw milk in the market. Condensed skim is widely available though, production is outpacing demand.

OIL

Soy Oil – The market is mixed. Soybean oil markets saw subdued holiday activity with notable influences from geopolitics and South American weather. Limited trading amplified sensitivity to headlines, including escalating Black Sea tensions that briefly lifted risk premiums across oilseeds. U.S. export inspections remained strong: 1.55 MMT in early December and 2.396 MMT by mid-month, with China accounting for a significant share. However, CBOT futures weakened as speculative traders reduced long positions and bearish sentiment spread due to large global inventories and robust palm oil competition. Weather in Argentina and Brazil was mixed with beneficial mid-Brazil rains offset by northern dryness, adding cautious optimism. Overall, the market balanced firm export data and supply risks with holiday-thinned liquidity and growing bearish pressure.

Canola Oil – The market is mixed. Canola oil markets exhibited choppy, holiday-thinned trading, swinging between technical rebounds and fundamental oversupply concerns. ICE canola futures rallied early in the period, driven by technical oversold conditions and spillover strength from crude oil and broader grain markets. Yet, global supply pressures lingered. Canada’s 2026 crop was revised upward to nearly 19 MMT, contributing to elevated stocks and weak export demand, particularly from China. Weekly export volumes remained below average, hindered by logistical bottlenecks and subdued Asian buying. Overall, robust domestic crush and technical buying offered short-term support, but ample supply and soft demand kept near-term sentiment subdued.

Palm Oil – The market is mixed. Palm oil markets ended the year on a mixed note. Malaysian exports rose modestly through December 25, driven largely by Indian demand ahead of festive seasons like Lunar New Year and Ramadan. However, inventories remained elevated, with December stocks reaching approximately 2.84 million tons up for a sixth straight month. A stronger ringgit also capped export competitiveness. Notably, the U.S. exempted Malaysian palm oil from a proposed 19% tariff, boosting sentiment. Overall, strong policy support and moderate export demand were balanced by persistent stock build-up and currency headwinds.

COCOA

The cocoa market is unsettled. Supply issues for cocoa have been exacerbated by long lasting structural problems within the industry. Price increases on cocoa and any products produced with cocoa should be expected throughout the year.

COCONUT

The coconut market is mixed. Desiccated coconut costs are expected to settle in the coming months as global export prices from countries of origin have started to soften. Tariffs continue to impact the cost of imported goods.

IMPORTED OLIVES

The upcoming olive crops across both green and ripe varieties are shaping up to be one of the most uneven in recent years, with notable swings in both volume and fruit size depending on the region.

Egypt – Egypt’s olive sector is positioned for sustained momentum in 2026, backed by steady domestic market strength and export strategy. Growth in olive production is being driven by government-led expansion of orchards, adoption of modern farming practices, and efficient harvest-to-processing linkages. Investment in sorting, packaging, and quality control is improving export consistency and supporting Egypt’s reputation in key regions like Europe, North America, and the Middle East.

Morocco – Morocco’s table olive outlook for 2026 is anchored by strong production, emerging value chain efficiencies, and evolving global demand. Favorable weather during the flowering period has fueled yields that not only surpass last year’s crop but also exceed the five-year average. The one caveat: an intense heat spell is likely to reduce average fruit size, with weather variability impacting yield consistency. Overall dynamics suggest stable supply, strengthened process capability, and expanding market reach for Moroccan table olives.

Spain – Spain’s table olive outlook for 2026 reflects strengthened market positioning, evolving consumer trends, and enhanced resilience amid climatic and competitive pressures. Following a rebound in production after recent challenges, quality continues to improve due to refinements in farming practices. Despite heat and dry spells impacting crop forecasts, processing capacity, and varietal focus on Manzanilla and Hojiblanca olives. Weather variability remains a core risk, while emerging producers in the Mediterranean and New World regions are intensifying competition.

MANDARIN ORANGES

China’s 2025/2026 Mandarin Orange harvest is now in progress, and early reports point to a healthy, promising crop. The forecast shows sustained momentum through a blend of production resilience, expanding demand, and improved trade flows. When paired with the sizable carryover from the 2024/2025 season, overall supply is projected to be strong, setting the stage for a softer, more relaxed market in the months ahead. Domestic demand remains strong, driven by health-conscious consumers and cultural significance during holiday seasons. This robust consumption underpins stability in the domestic market, encouraging continued agricultural investment.

SUGAR

Domestic Cane Sugar – The market is mixed. U.S. sugar supply for 2025/26 is projected at 14.119 million short tons, raw value (STRV), a small decrease of 1,802 from last month as a reduction in imports narrowly offsets increases in beginning stocks and production. Cane sugar in Louisiana is projected at 2.162 million STRV (up 105,771 over November) and Florida is at 2.082 million STRV (up 29,879).

Domestic Beet Sugar – Beet sugar is projected at 5.098 million STRV, assuming sucrose recovery. August to September 2026 production is projected at 10-year averages and beet pile shrinkage at 8.660 percent. The shrinkage projection is from processors’ reporting forecasts in December and is higher than the 6.727% assumed in November. Overall beet production ended up decreasing 113,256 STRV from November. Imports have decreased 24,639 STRV to 2.289 million.

Mexico sugar production is projected at 5.094 million metric tons (MT), an increase over last month but still trending below earlier optimistic recovery prospects of some months ago. Rain and flooding in the states of Puebla, Veracruz, and San Luis Potosi have diminished sugarcane yield prospects.

RICE

The outlook for 2025/26 U.S. rice for December is for reduced supplies, unchanged domestic use, lower exports, and higher ending stocks. All rice supplies decreased on lower imports, down 1.0 million cwt to 49.7 million all on a reduction in long-grain imports. Long-grain exports are reduced 2.0 million cwt to 62.0 million on continued sluggish sales and shipments of rough rice to Mexico and other Latin American markets.

The 2025/26 global outlook this month is for increased supplies, lower consumption, higher trade, and larger ending stocks. Supplies are raised by 1.7 million tons to 730.7 million, as higher beginning stocks more than offset lower production. Beginning stocks are increased primarily for India, based on higher-than-expected beginning stocks reported by the Food Corporation of India. World production is forecast to be 540.4 million tons, down 0.5 million this month.

**Graphs represent data for the week ending Jaanuary 16, 2025**